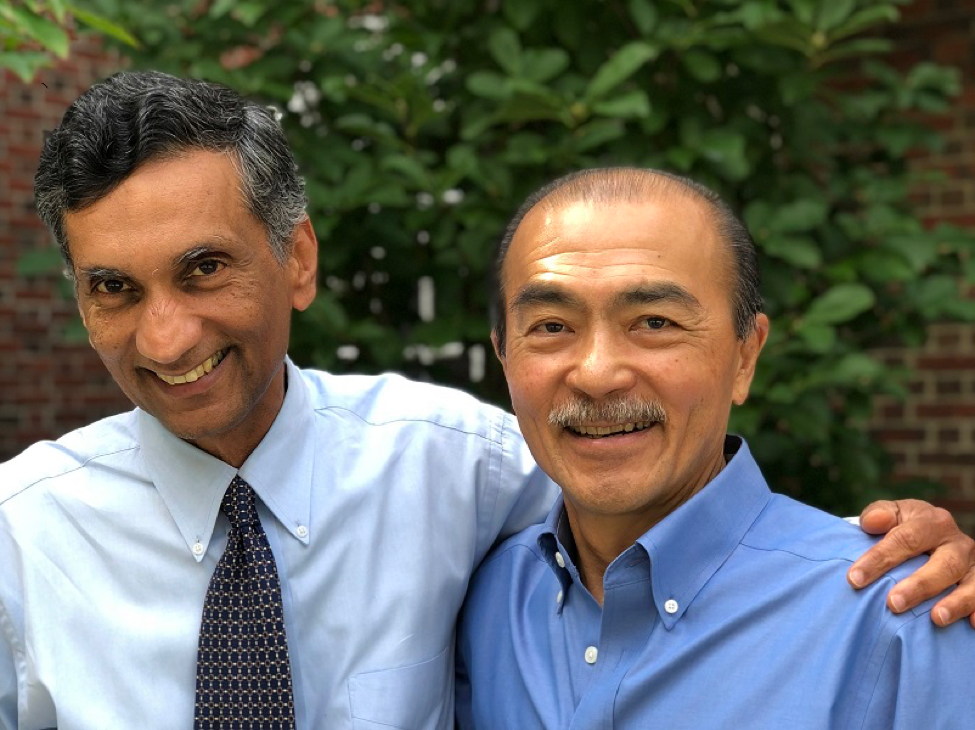

The HBS-Accion Program on Strategic Leadership in Inclusive Finance is a Harvard Business School Executive Education program developed a Harvard Business School Executive Education program developed with the Center for Financial Inclusion at Accion, an "action-oriented" think tank working toward financial inclusion worldwide. The program is led by faculty co-chairs Kash Rangan and Michael Chu.

Kash Rangan is a co-founder and faculty co-chair of the HBS Social Enterprise Initiative, and teaches extensively at Harvard Business School in both the MBA program and executive education. Michael Chu is a senior lecturer in the HBS Social Enterprise Initiative and is also a co-founder and partner of IGNIA Fund. Both lead the HBS MBA course Business at the Base of the Pyramid.

We asked Professors Chu and Rangan to share some thoughts with Impact Insights on financial inclusion.

Why did the two of you get involved in launching the Strategic Leadership in Inclusive Finance program?

First of all, HBS’s mission is to educate leaders who make a positive difference in the world. The opportunity to partner with Accion to design and execute this program is right at the center of gravity of our mission. Leaders of financial inclusion enterprises, be they regulated financial entities, fintechs or microfinance institutions, are all engaged in bringing much needed financial services to low-income and underserved segments of the population. At HBS, we research and develop programs on leadership and strategy, so the Strategic Leadership in Inclusive Finance program is a thoughtful application that directly addresses an important societal need.

Both of us had a long relationship with Accion. Kash’s long-standing interest in social impact and low-income populations naturally led him to Accion as a pioneer of microfinance. Michael served on the board of Accion, where he was so taken by microfinance that he retired from KKR and went on to serve as Accion’s CEO prior to joining the HBS faculty. So when Elisabeth Rhyne, now Managing Director of the Center for Financial Inclusion at Accion, came to us to propose an executive program at HBS for the key protagonists shaping the field, we jumped at the opportunity.

How do you define inclusive finance and what is the goal of financial inclusion?

Inclusive finance is the availability of financial services, in all their dimensions, to all, no matter where you are on the socio-economic pyramid or whether you live in an urban setting or a rural farm. The goal is to provide services in the shape and form that will accomplish two things―allow access to people whose assets will be preserved and increased through financial services while denying it to those who would only be saddled with commitments they cannot meet.

As simple and laudable as the goal of financial inclusion appears, it is often very difficult to pull it off successfully. How do you identify and differentiate the customer for whom financial inclusion is the path to upward mobility from the customer for whom financial inclusion is the difference between subsistence and falling into poverty? When do you walk away from someone who you think is likely to become over-indebted? Are there different financial products for customers at different stages? How do you design for that? And even if you master the product side, the access side of reaching those clients and delivering those services is a massive undertaking, requiring innovation and inspiration.

What do participants experience in the program? What value do they gain from the experience?

Rapid change has been a constant in the decades it took for financial inclusion to develop from NGOs issuing small working capital loans to today’s microfinance icons that are vital components of their national banking systems and on to the fintechs that are changing the basics of delivery and credit scoring. It is also a global phenomenon, present in all continents, in both developed nations and emerging economies. Accordingly, SLIF is an opportunity for industry protagonists to be exposed to what is happening globally, in all respects, from product and technology to oversight and regulation. But even more importantly is what this exposure in the company of a select cohort of peers enables―the deep change in the perception of one’s own challenges and opportunities that could not have happened otherwise.

Just stepping away from the day-to-day of leading an organization to having downtime to reimagine one’s core business in the company of like-minded individuals and stakeholders – it’s a transformational opportunity. Time and again participants have told us that the program gave them an enhanced clarity in assessing what challenges and opportunities they faced, and a renewed vigor that such challenges, in fact, can be successfully addressed.

Are there significant changes facing the financial inclusion industry?

Just as microfinance changed the practice of conventional banking at the start of the 21st century, the field today is in the process of a major disruption. In little more than a decade, three major developments have changed financial services in profound ways: 1) the capability of artificial intelligence and machine learning to process extraordinary amounts of data at ever-faster speeds and ever-lower costs; 2) the possibility to move that data back and forth through the internet nearly for free; and 3) the ability to download and upload to that data stream from smartphones. This technological tsunami is just reaching the underserved and the fintech revolution has already ushered in a new era of financial inclusion. The course gives participants a chance to think about how they can best respond to these dramatic shifts.

Designed for leaders from all facets of the financial inclusion industry, the Strategic Leadership in Inclusive Finance program is held annually in late March/early April. To learn more or to apply, visit the Center for Financial Inclusion website.